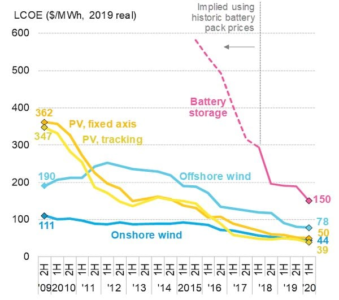

More battery storage equals less gas. Batteries are usurping the role of gas in the power system. Grid scale battery usage is increasing rapidly, and battery cost deflation is faster than wind or solar.

AGL Energy, a company whose very name is synonymous with the gas industry and who produced the iconic natural gas “Living Flame” advertising campaign in 1979, announced on 13 August 2020 that the falling cost of battery storage makes a case for big batteries usurping the role of gas in a renewables rich grid.

On 17 August 2020, AGL Energy’s newly appointed chief operating officer Markus Brokhof said: “There is a clear business case for big batteries.” He added that they were starting to compete with gas peakers on commercial terms to firm up supplies of wind and solar.

Gas is struggling to compete with batteries, with gas prices globally being at historic lows.

When gas prices recover, gas will not be able to compete. The cost deflation will ensure batteries pay a larger role in the power system at the expense of gas in the very short term.

AGL’s Climate Statement commitments 2020 are geared towards decarbonisation and investment in renewable sources of electricity supply and integration. The company now has big plans for installing several new batteries to complement its power generating operations.

AGL has set a goal of installing 1,200 megawatts (MW) of new battery storage and demand response capacity by 2024, and is tying executive and senior management bonuses to reaching growth targets for the company’s clean energy and storage portfolio.

It has also lodged initial development plans for a new big battery of up to 500MW at its Liddell coal-fired power station site in the Hunter Valley, New South Wales. It plans to construct a 150MW battery in the first instance following the station’s closure in 2023.

Further, at its Torrens Island gas-fired power station in South Australia, AGL is installing a 100-150MW battery in its initial stage.

Increasingly, wind and solar projects are being co-located with batteries.

AGL is progressing plans to add a 100MW/150MWh battery next to the proposed Wandoan solar farm in Queensland, and up to 200MW/400MWh of battery capacity spread across four sites in partnership with the Maoneng Group, including a 50MW/100MWh battery next to the Sunraysia solar farm in New South Wales.

Battery Cost Deflation Even Steeper Than Wind and Solar

In the U.S., we are seeing grid scale battery projects emerge that are of a scale to rival gas peaking plants.

Vistra in the U.S. has approval to expand an energy storage system under construction at its Californian gas-fired Moss Landing generation station to 1,500MW/6,000MWh. This is gigawatt-scale battery energy storage.

At present, the largest battery in the world is the Hornsdale Big Battery in South Australia. It boasts a size of 150MW/193MWh. Hornsdale is 10% of the power and 3% of the duration of Vistra’s new battery. Vistra’s is the largest battery storage installation in the world and when completed, will be larger in capacity than every other utility-scale battery energy storage system in the U.S. combined.

And Capital Dynamics, an independent global private asset management firm, has signed an agreement with U.S. energy company Tenaska to develop a portfolio of nine battery energy storage system (BESS) projects located throughout California. In total, the projects will provide approximately 2,000MW of power. The scale of this investment into grid scale batteries is unprecedented.

Meanwhile in Australia, grid scale battery investment has arrived.

On 20 August 2020, French owned renewable company Neoen filed plans for a $3bn wind and solar farm with a battery 10 times bigger than the Hornsdale big battery. The Goyder South project in South Australia proposes 1200MW of wind energy, 600MW of solar PV, and a 900MW/1800MWh battery dwarfing the size of the Hornsdale big battery.

These types of hybrid projects, that totally exclude gas, are the future of the power system.

Grid scale batteries are now a feature of the energy market in Australia, with gas usage for gas-powered generation declining by 58% since 2014, and gas demand from all sectors declining by 21% since 2014.

Whilst in the short-term grid scale batteries will not totally usurp the role of gas in the power system, increasingly they will eat into gas’ market share.

The continued decline of gas as a fuel source for power generation looks assured.

Gas is now a declining industry in Australia.

Bruce Robertson is an LNG/gas analyst with IEEFA.

This commentary first appeared in Renew Economy.